The Payback Rule Always Makes Shareholders Better Off

The payback rule always makes shareholders better off true when you have to choose between projects with different lives you should put them on equal footing by computing the equivanlent annual annuity or benefit of the two projects. 17 Which of the following statements is incorrect regarding the payback period from FINANCE 1633 at Hoa Sen University.

There are five projects to consider for investment chance using Payable Rule.

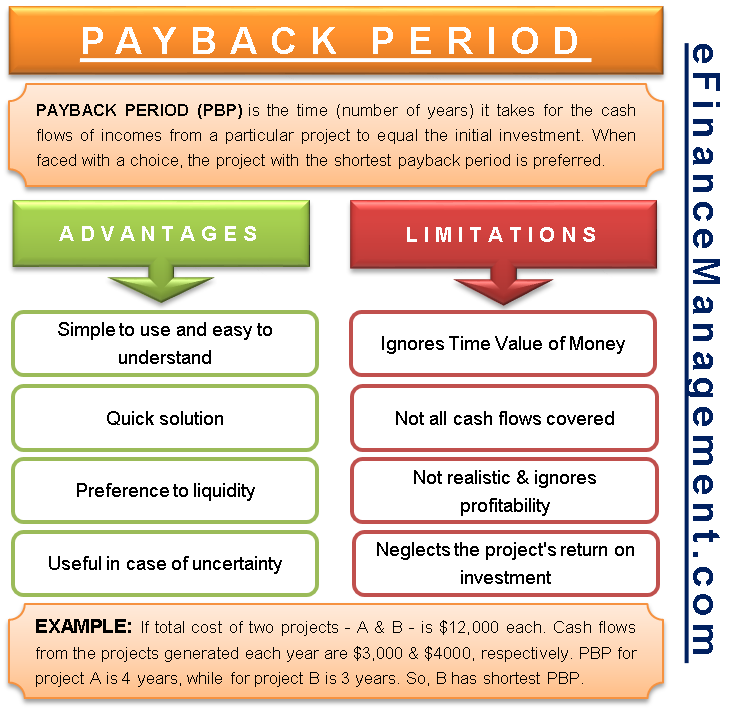

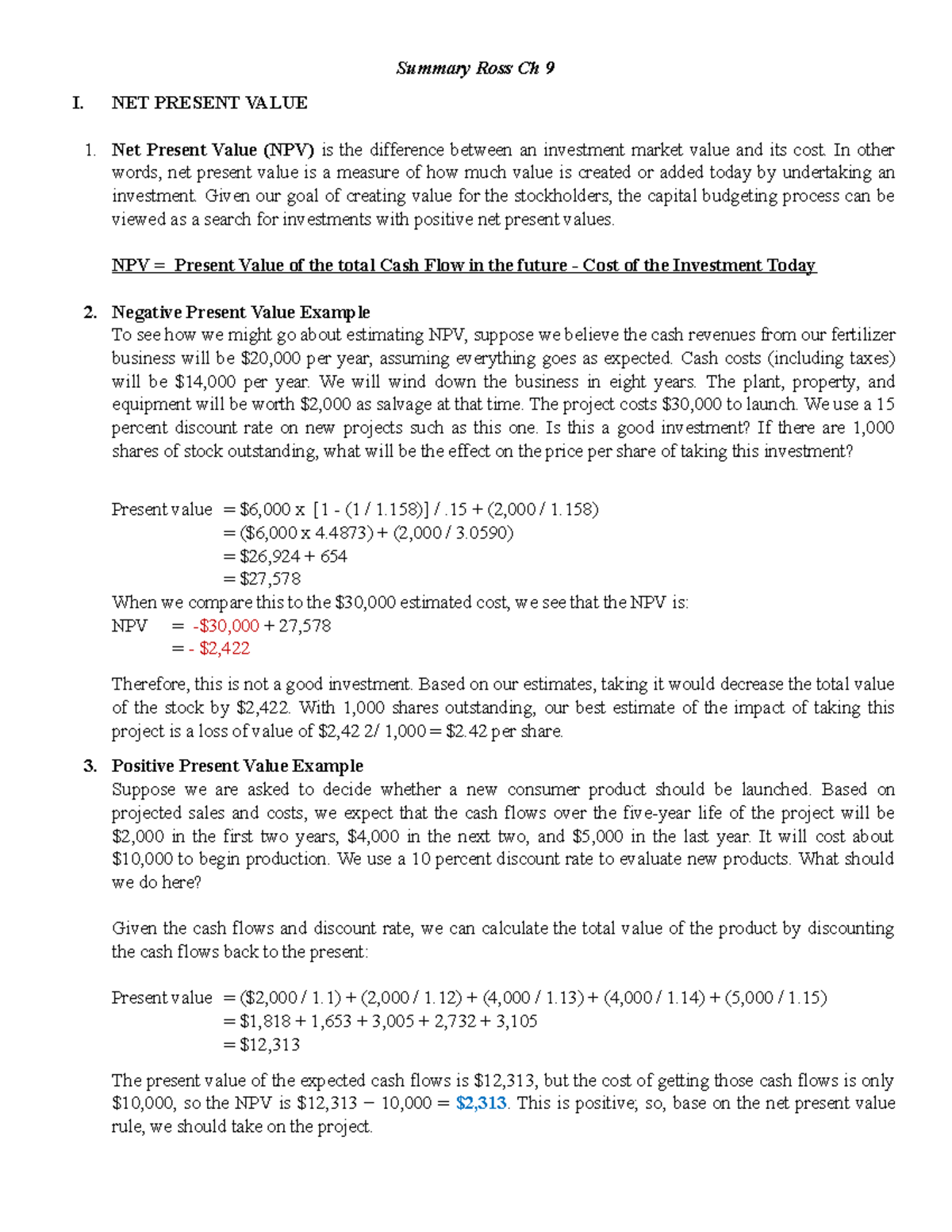

. NPV Net Present Value is calculated in terms of currency while Payback method refers to the period of time required for the return on an investment to repay the total initial investmentPayback NPV and many other measurements form a number of solutions to. The payback period refers to the amount of time it takes to recover the cost of an investment or how long it takes for an investor to hit breakeven. Leave a Reply Cancel reply.

When to postpone an investment expenditure. Next we take a closer look behind the scenes of the NPV rule. Payback period is very easy to compute and apply.

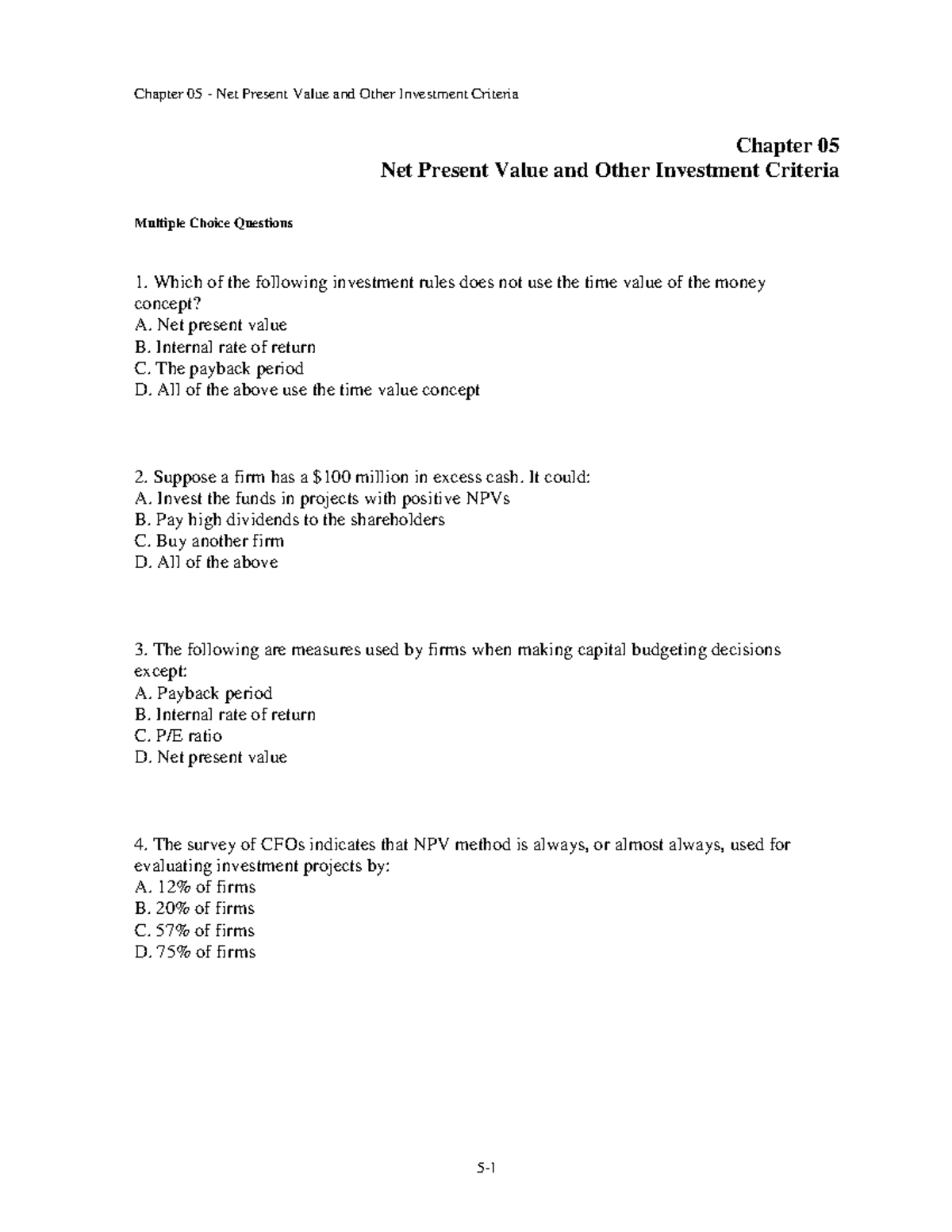

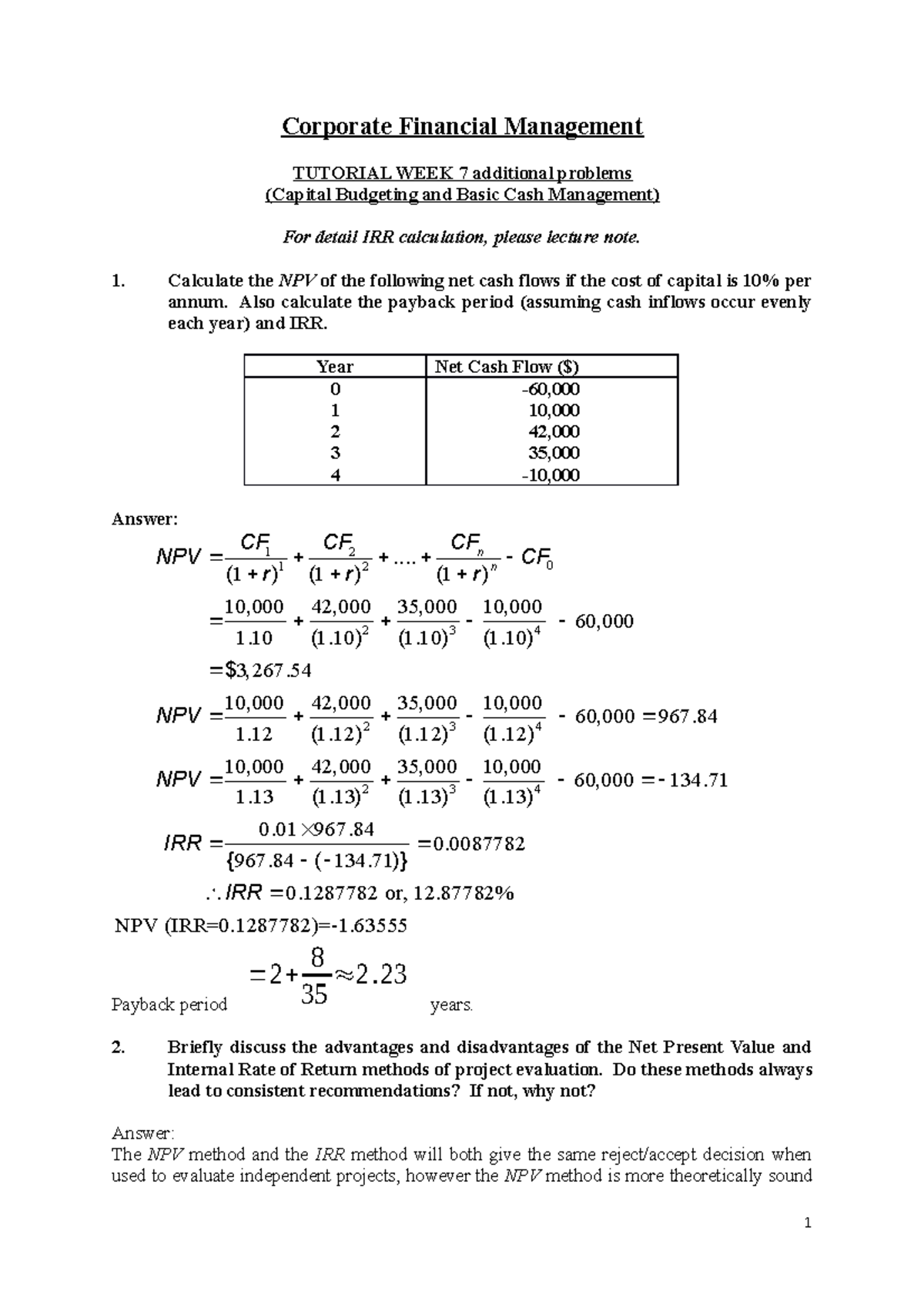

Learning Objective 08 03 Explain why the payback and discounted payback rules from MCS 4600 at University of Guelph. How to choose between projects. 2 calculate IRR of a project adn know what to look out for when using the Internal rate or return rule.

Why doesnt the payback rule always make shareholders better off. Because of deficiencies associated with the payback method it is seldom used in corporate financial analysis today. A projects payback period is the length of time necessary to generate an NPV of zero.

See the answer See the answer See the answer done loading. This problem has been solved. Despite its appeal the payback period analysis method has some significant drawbacks.

For mutually exclusive projects the project with the higher IRR and not the number of profitable years is the correct selection tf false. Calculate the internal rate of return of a project and know what to look out for when using the internal rate of return rule. The payback rule has nothing to do with the well-being of the shareholders.

A short payback period reduces the risk of loss caused by changing economic conditions and other unavoidable reasons. The payback rule always makes shareholders better off. Chapter 8 - NPV and Other Investment Criteria.

Using a simple example we show how managers who follow the NPV rule make shareholders better off and how following the NPV rule can help to reconcile diverging preferences of investorsThis also allows us to revisit some of the assumptions we make when working with net present values. Define the payback rule and explain why it doesnt always make shareholders better off. The payback period is important for the firms for which liquidity is very important.

The payback rule states that a project is acceptable if you get your money back within a specified period. Define the payback rule and explain why it doesnt always make shareholders better off. How can the net present value rule be used to analyze three common problems that involve.

5 Calculate the profitability index and use it to choose between projects when funds are limited. Why doesnt the payback rule always make shareholders better off. Payback period41 cutoff period3 so company should reject this project.

Assume a particular cutoff time is two year. 3 explain why the payback rule doesnt always make shareholders better off. NPV vs Payback Method.

The payback rule always makes shareholders better off F TF. Question 1a Explain what is unique risk and what is market riskb Explain why the payback rule doesnt always make shareholders better offc What information about company stocks is generally reported in the financial pages of the newspaper. Payback periodinitial investment annual cash flow 100024441 years.

And when to replace equipment. Why doesnt the payback rule always make shareholders better off. Required fields are marked.

Calculate the profitability index and use it to choose between projects when funds are limited. The payback period considers all project cash flows tf false. When projects are mutually exclusive you should choose the project with the.

Understand the payback rule and explain why it doesnt always make shareholders better off. The payback period considers all project cash flows. When you have to choose between projects with different lives you should put them on an equal footing by computing the equivalent annual annuity or benefit of the two projects.

Payback Period Method Bailout Payback Method Rule of 72. The payback rule always makes shareholders better off tf false. It only tells the company when they should expect to break even.

Why dont the payback rule and book rate of return rule always make shareholders from BUSFIN 1030 at University of Pittsburgh-Pittsburgh Campus. An investment with short payback period makes the funds available soon to invest in another project. Your email address will not be published.

Payback period 26 year because the sum of the cash flows. Limitations of Payback Period Analysis.

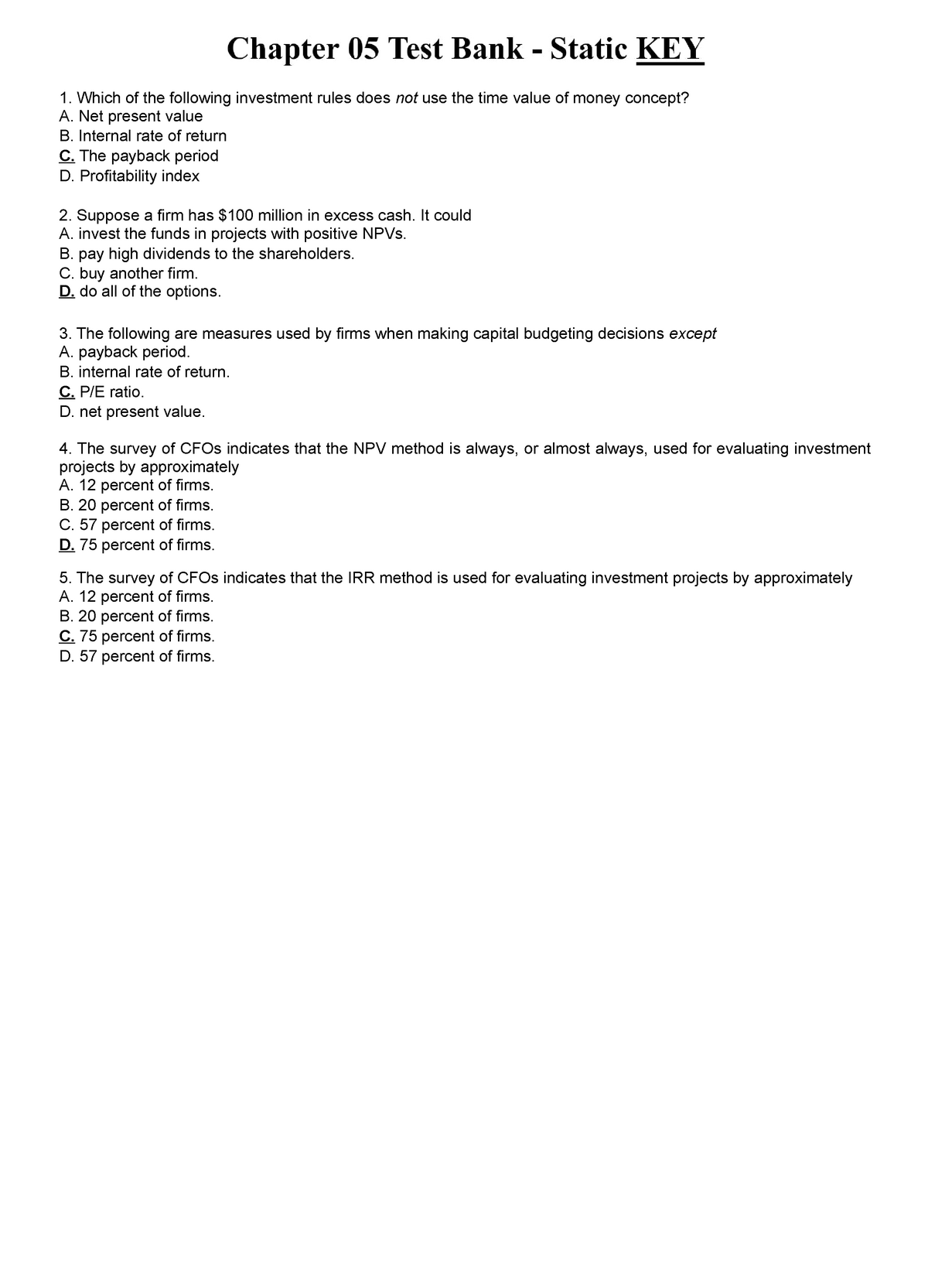

Chapter 05 Test Bank Static Which Of The Following Investment Rules Does Not Use The Time Value Studocu

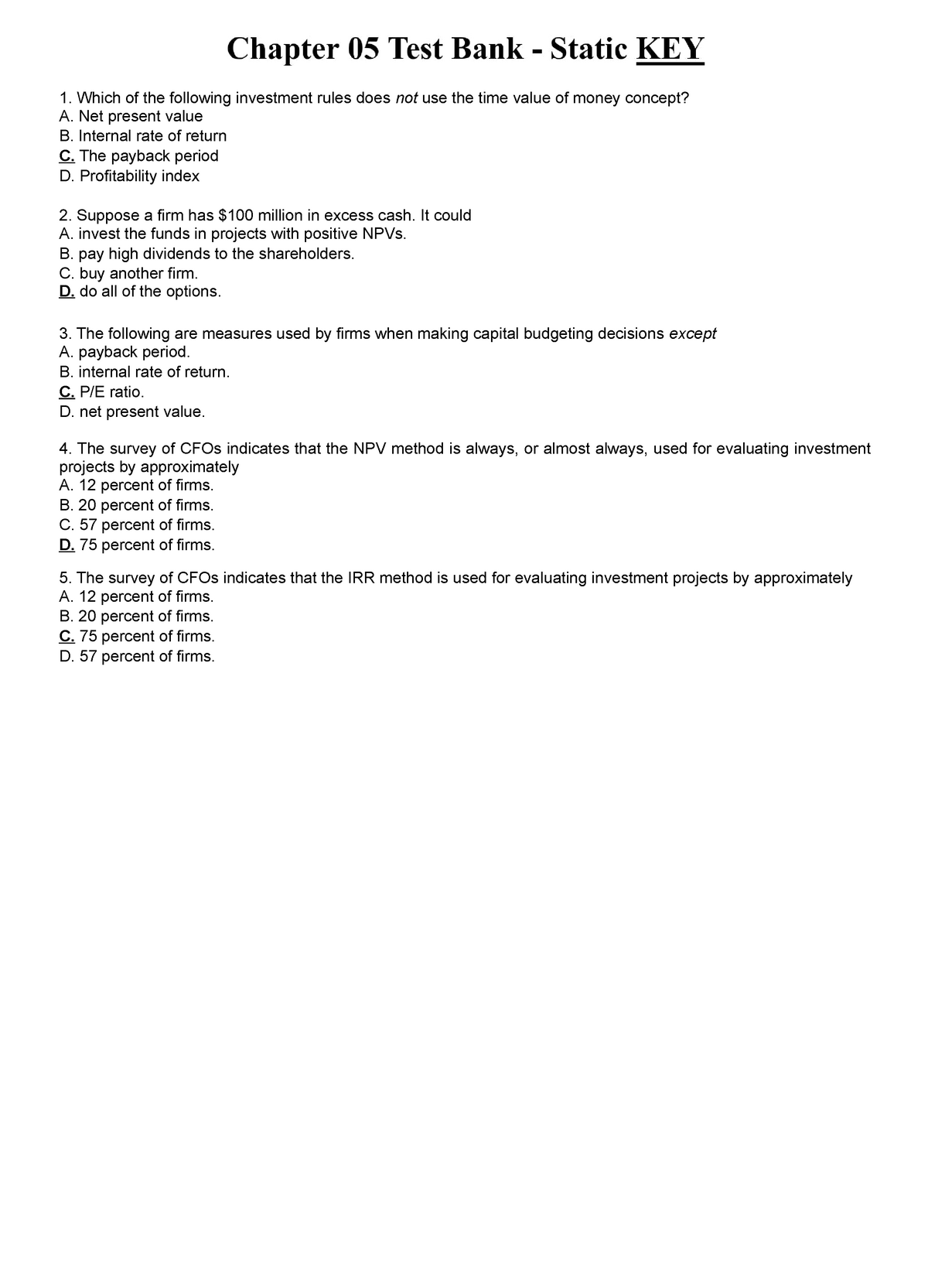

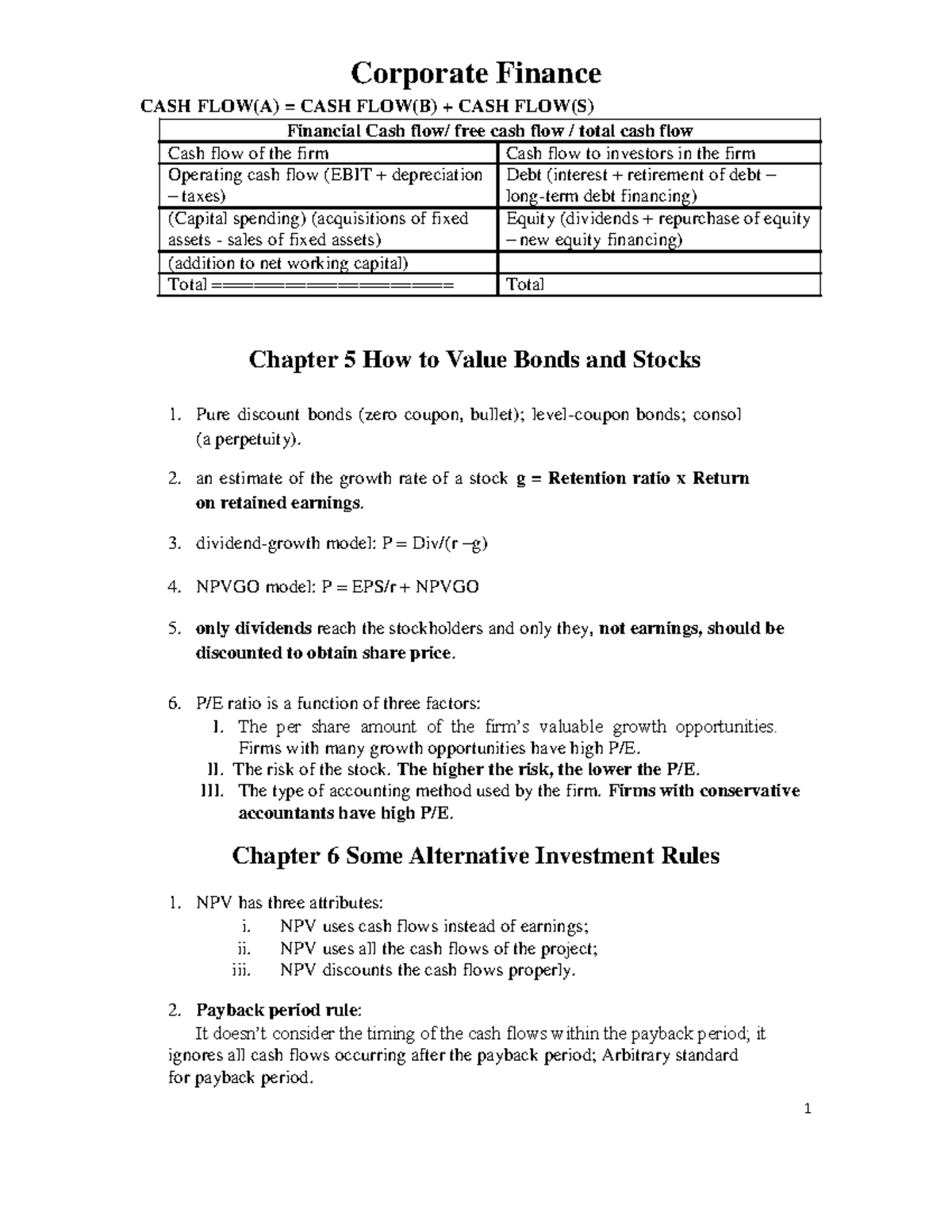

Solved Question 4 Which Of The Following Statements Is True Chegg Com

Pdf Contravention Between Npv Irr Due To Timing Of Cash Flows A Case Of Capital Budgeting Decision Of An Oil Refinery Company

Energies Free Full Text Analysis Of The Financing Options For Pro Ecological Projects Html

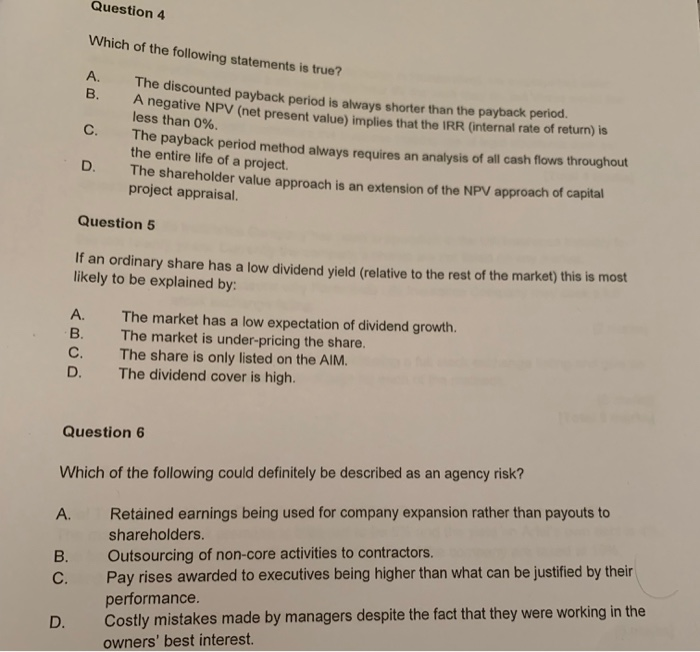

Corporate Finance Ross Corporate Finance Cash Flow A Cash Flow B Cash Flow S Financial Cash Studocu

Disadvantages And Advantages Of Payback Period Efinancemanagement

Chap005 Test Finc 850 Financial Management Ud Studocu

Dafhfdahdfahdfahfdhdahdfhdfahdahfh Docsity

Capital Budgeting Mathematics Quiz Quizizz

Answer For Workshop 7 Additional Problems Corporate Financial Management Tutorial Week 7 Studocu

Summary Ross Ch 9 Manajemen Keuangan Unpak Studocu

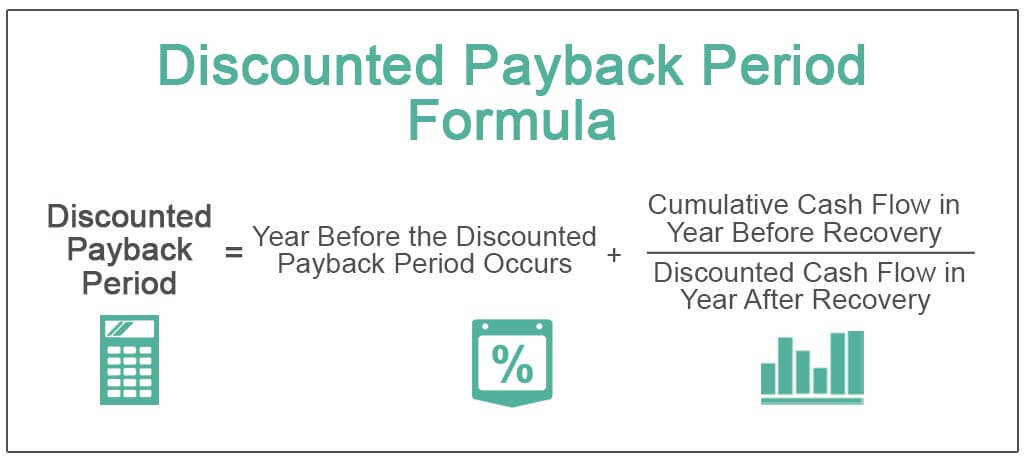

Discounted Payback Period Meaning Formula How To Calculate

Solved Question 1 A Financing Project Is Acceptable If Its Irr Is Greater Than The Discount Rate Exactly Equal To Zero Less Than The Discount Ra Course Hero

Comments

Post a Comment